White-Label Payment Gateway Tools

The

success of a white-label payment gateway depends significantly on the tools it

offers. These tools streamline operations, enhance user experiences, and ensure

regulatory compliance. By leveraging these functionalities, businesses can

create tailored, scalable, and secure payment systems under their own brand.

This

article delves into the essential tools that make white-label payment gateways

an indispensable asset for businesses across industries.

What Is a White-Label Payment Gateway?

A

white-label payment gateway is a customizable payment processing solution that

allows businesses to operate under their own brand name. It offers advanced

functionalities and tools, ensuring seamless transactions, fraud prevention,

and analytics while eliminating the need for businesses to develop proprietary

payment technology.

Key Tools Offered by White-Label Payment Gateways

1. Payment Integration Tools

Seamless

integration is crucial for a functional payment system. These tools allow

businesses to:

- Integrate Payment APIs: Connect the gateway with

websites, mobile apps, and Point-of-Sale (POS) systems effortlessly.

- Support Multiple Payment

Methods:

Enable credit cards, digital wallets, bank transfers, and

cryptocurrencies.

- Offer Plugins: Prebuilt plugins for

popular platforms like Shopify, WooCommerce, and Magento streamline

implementation.

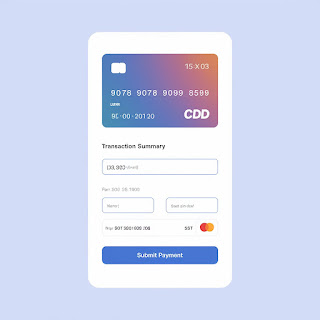

2. Customization and Branding Tools

White-label

gateways offer businesses the ability to customize the look and feel of their

payment interfaces. Tools include:

- UI/UX Design Editors: Personalize checkout pages,

invoices, and dashboards to align with the brand’s identity.

- Multi-Language Support: Cater to global customers

with localized interfaces and communications.

- Theme Options: Choose from pre-designed

templates or create custom themes.

3. Security and Fraud Prevention Tools

Maintaining

trust in online transactions requires advanced security measures. Key tools

include:

- Fraud Detection Systems: AI-powered fraud detection

mechanisms to monitor and flag suspicious activities.

- Tokenization: Replace sensitive card

information with unique tokens for secure storage and transmission.

- PCI-DSS Compliance

Management:

Ensure adherence to industry security standards without added complexity.

- Chargeback Mitigation Tools: Manage disputes effectively

to reduce chargeback ratios.

4. Analytics and Reporting Tools

Data-driven

insights are essential for optimizing payment operations. White-label gateways

provide:

- Transaction Analytics: Track metrics such as

success rates, decline rates, and customer behaviors.

- Customizable Reports: Generate detailed financial

and operational reports tailored to business needs.

- Real-Time Monitoring: Access dashboards for

instant updates on transaction statuses and performance.

5. Multi-Currency and Cross-Border Tools

For businesses

with a global presence, these tools ensure seamless international transactions:

- Currency Conversion Engines: Automatically convert

currencies based on real-time exchange rates.

- Multi-Currency Acceptance: Allow customers to pay in

their local currency.

- Localized Payment Methods: Support region-specific

payment options such as UPI in India or iDEAL in the Netherlands.

6. Recurring Payment Management Tools

Subscription-based

businesses rely on recurring billing features to manage customer payments

effectively:

- Automated Billing Cycles: Schedule payments for

weekly, monthly, or annual intervals.

- Retry Logic: Automatically retry failed

transactions to improve collection rates.

- Subscription Analytics: Monitor customer retention

rates and predict churn using detailed data.

7. Developer and API Tools

APIs are

the backbone of any white-label gateway, offering flexibility for developers:

- Open APIs: Enable businesses to build

custom integrations tailored to their workflows.

- SDKs (Software Development

Kits):

Simplify development for mobile and desktop platforms.

- Sandbox Environments: Test payment integrations

in a simulated environment before going live.

8. Compliance Management Tools

Regulatory

compliance is essential for avoiding penalties and gaining customer trust:

- AML and KYC Tools: Automate customer

verification processes to comply with Anti-Money Laundering and Know Your

Customer regulations.

- Tax Management Systems: Calculate and apply taxes

based on customer location and transaction type.

- Data Privacy Compliance: Tools to adhere to GDPR,

CCPA, and other regional privacy laws.

9. Customer Support and Communication Tools

Customer

satisfaction hinges on robust support systems, enabled by:

- Integrated Help Desks: Provide in-app support via

chat, email, or phone.

- Automated Notifications: Send payment confirmations,

subscription reminders, and security alerts.

- Feedback Collection Systems: Gather insights into

customer experiences to refine operations.

10. Scalability and Performance Tools

Growing

businesses need systems that can scale effortlessly:

- Load Balancers: Ensure consistent

performance even during high transaction volumes.

- Cloud-Based Infrastructure: Leverage scalable resources

for uninterrupted operations.

- Downtime Management Systems: Minimize impact with

failover mechanisms and real-time updates.

Emerging Innovations in White-Label Payment Gateway

Tools

1. Artificial Intelligence (AI) Tools

- Fraud Detection: AI algorithms that analyze

patterns to detect anomalies.

- Customer Insights: AI-driven analytics for

hyper-personalized recommendations.

2. Blockchain-Based Tools

- Transparency: Enable traceable

transactions using blockchain technology.

- Smart Contracts: Automate payment terms and

reduce processing delays.

3. Real-Time Analytics Dashboards

- Provide instant insights

into performance metrics, allowing businesses to make informed decisions

faster.

Benefits of Using Advanced Tools in White-Label

Payment Gateways

- Enhanced Customer

Experience:

Streamlined checkout processes reduce cart abandonment rates.

- Operational Efficiency: Automation minimizes manual

interventions and human errors.

- Global Reach: Multi-currency and

localization tools cater to diverse customer bases.

- Data Security: Robust security measures

build customer trust and loyalty.

Conclusion

White-labelpayment gateway tools are at the heart of seamless and efficient payment

ecosystems. From security and analytics to compliance and branding, these tools

equip businesses to meet modern payment challenges while enhancing customer

satisfaction.

For

businesses looking to stay competitive in the digital economy, leveraging the

right white-label tools is essential. By investing in these technologies, you

can deliver personalized, secure, and scalable payment solutions that align

with your brand and operational goals.

Comments

Post a Comment